Managing a real estate business can be tedious because of the increasing demand for rental properties. That is the distinct purpose of receipts for non-profit donations. When an individual or an organization donates to Goodwill or the Salvation Army, the value of their contribution will be deducted with a payment receipt. Whether an individual or a business wants to claim cash or gift contributions to an IRS-recognized 501 (c)(3) non-profit organization, they need to provide a receipt to avail of the benefits. Reading the receipt is imperative too as it usually contains information about the return policy, and how many days from the date of purchase a customer can return the wrong item.

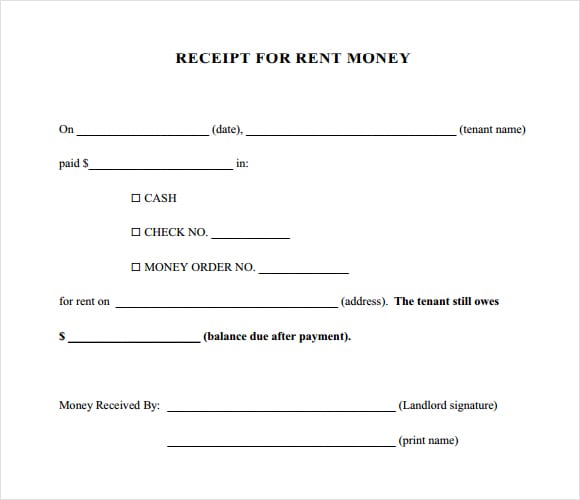

The customer might not able to exchange the item without an official receipt. For instance, a customer got the wrong size or decided to choose a different color, they have to present the cash receipt to return the item. If a business offers returns and exchanges policies, it often requires a receipt as part of the process. More so, a receipt also records any discounts on sales or allowances, and later on, used for accounting and financial reporting. Also, receipts serve as crucial documentation of sales transactions when the IRS audits on its tax returns. The business’s bookkeeping or accounting department can reference receipts when a question arises about the details of a particular transaction. Receipts are kept by businesses for internal accounting because it allows effective tracking of sales and revenue. Furthermore, receipts can also communicate company policies and offer discounts. Because it notes the customer’s purchase detail like itemized products and services, unit prices, date of purchase, subtotals, taxes, and totals, buyers can use it for record-keeping. To know more about the importance of a receipt, continue reading the list below.īesides being proof of a transaction, a receipt serves as an effective communication tool with customers. The IRS suggested that customers must keep official sales receipts for at least three years from the date the transaction was made. If you didn’t know, receipts are more than just a piece of paper that you tear apart or throw into the trash can. Why Is a Receipt Important to a Business? The IRS suggested keeping official sales receipts for at least three years or until needed for the administration of any provision of the Internal Revenue Code. Meanwhile, the Harvard Joint Center for housing said that there were 43 million renters in the US in the second quarter of 2017. In some places, employees present a monthly rent receipt to their HR officer to avail of a house rent allowance.Īccording to a report by Pew Research Center, the number of rented households in the US has increased significantly from 31.2% in 2006 to 36.6% in 2016. It contains important information like the amount of rent, the date of payment received, and the method of transaction. A monthly rent receipt is issued to document rent payment between the lessee and the lessor. Giving out receipts is not just a vendor-consumer thing, it is also issued in business-to-business transactions, stock market dealings, and even in the renting process. Moreover, when the Internal Revenue Service (IRS) requires documentation of certain expenses and declaration of Income Tax, receipts are used. And aside from showing ownership, receipts are essential for some other reasons. For example, a retailer demands that a customer must show an official receipt in exchanging or returning items, the same way as producing a receipt for product warranty purposes.

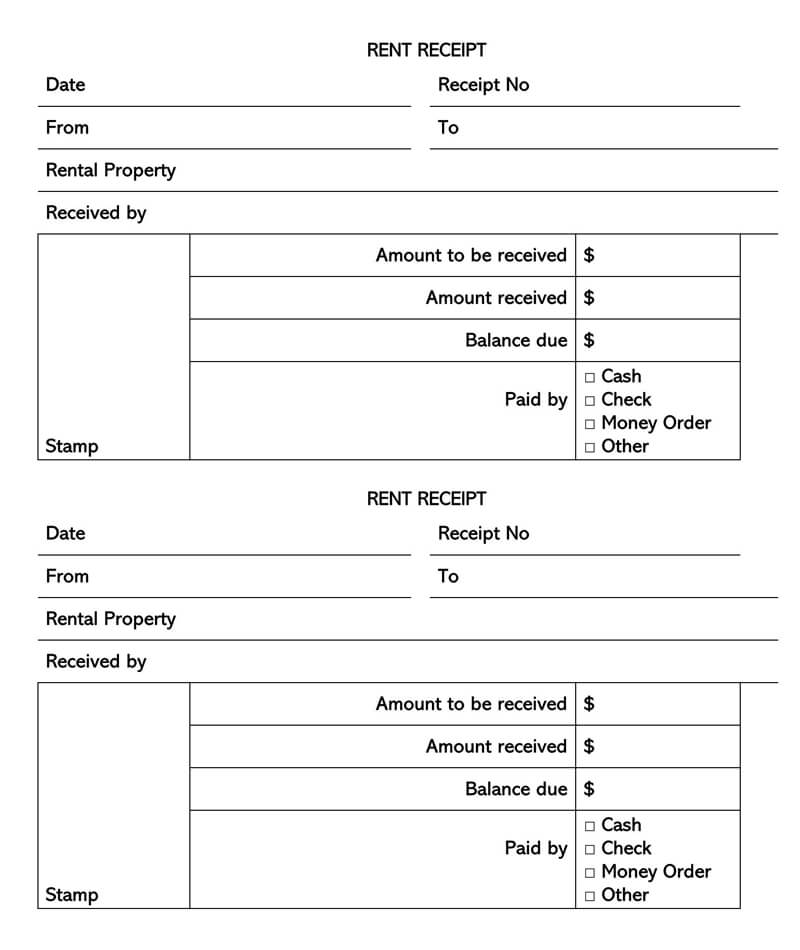

RENT RECEIPT PDF DOWNLOAD

RENT RECEIPT PDF FREE

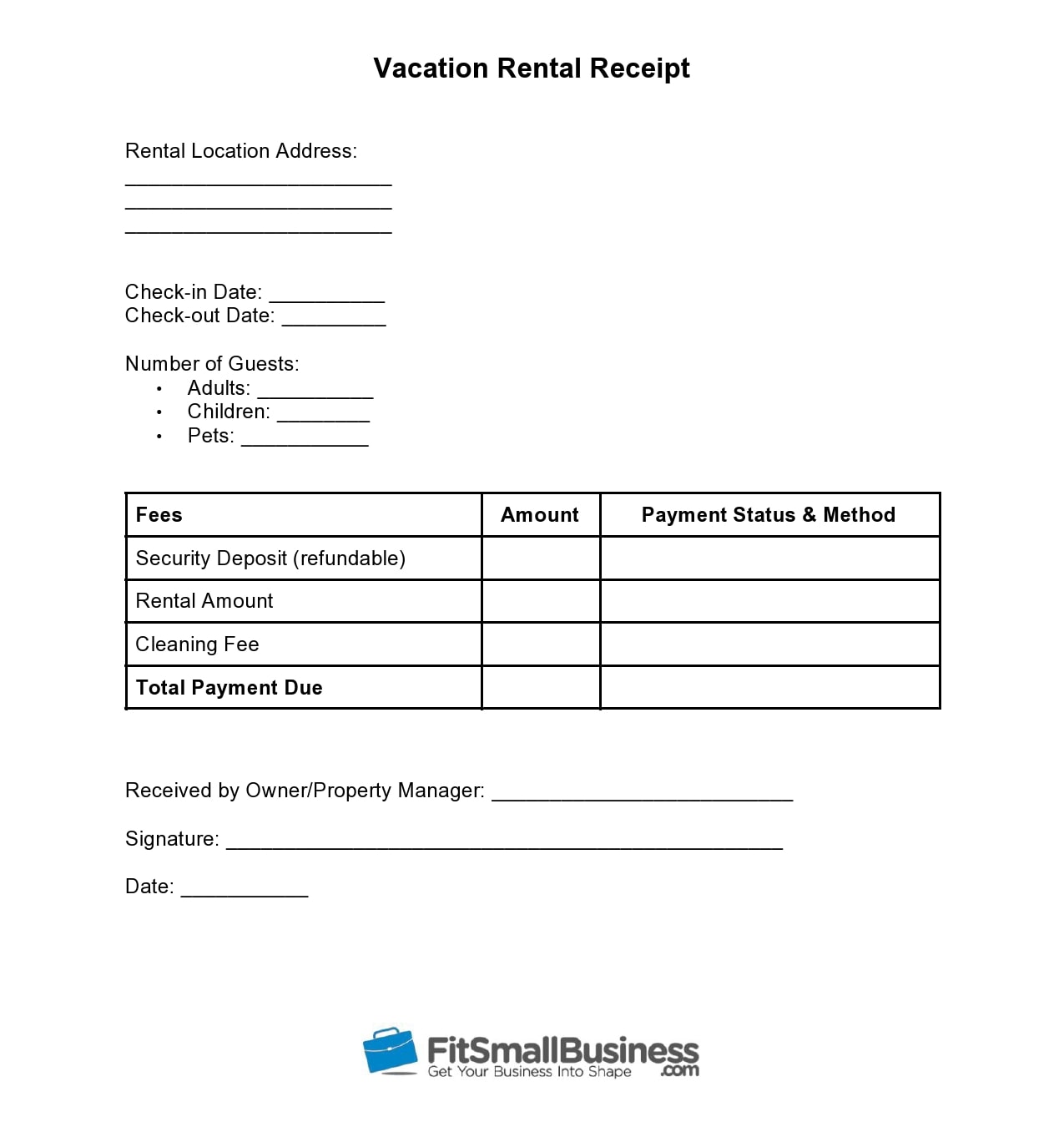

Free Rent Receipt Template download now.Monthly Rent Slip Receipt Template download now.Simple Monthly Rent Receipt Template download now.Monthly Service Rent Receipt download now.

0 kommentar(er)

0 kommentar(er)